The reform plan of art examination will be released in many places, and the enrollment of art examination will have these new changes!

BEIJING, Beijing, March 15 (Reporter Yuan Xiuyue) The Beijing Education Examinations Institute issued a notice on the 14th, and by 2024, six art majors, including music, dance, performance, broadcasting and hosting, art and design, and calligraphy, will be fully implemented in the city.

Since the beginning of this year, Shanxi, Xinjiang, Guangdong, Zhejiang, Hunan and other places have also issued implementation plans, and the timetable for the reform of the college entrance examination is accelerating.

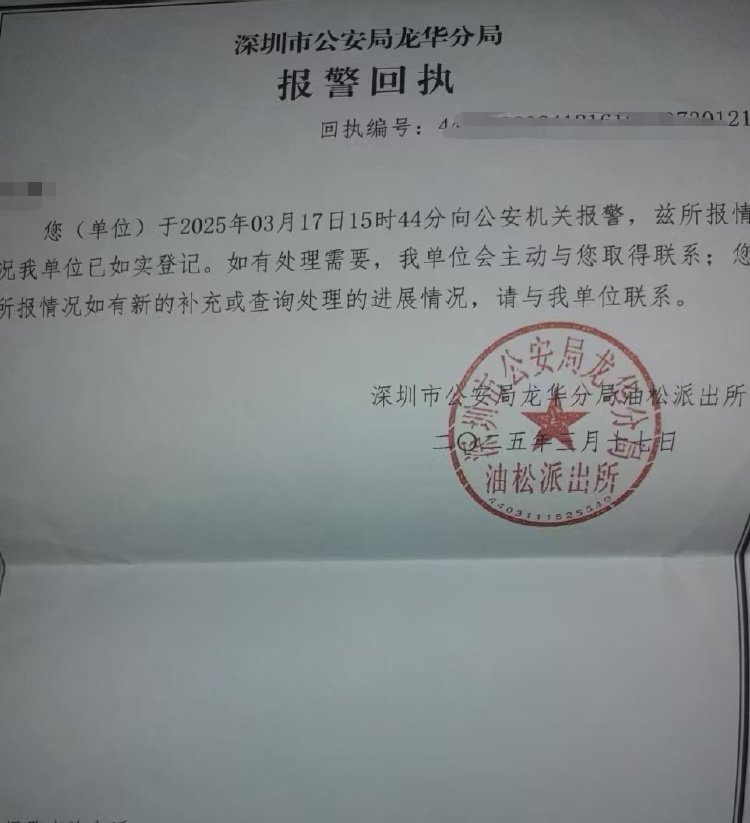

Webpage screenshot

Beijing will implement unified examination for six art majors next year.

According to the Notice of Beijing Municipality on Further Strengthening and Improving the Enrollment of Art Majors in Colleges and Universities (hereinafter referred to as the Notice), the enrollment of art majors in colleges and universities adopts the examination evaluation method of "cultural quality+professional ability", and the cultural quality uses the results of the national college entrance examination and the professional ability uses the results of the art professional ability examination.

The art professional ability examination includes the city-wide unified examination and the college examination, and the classified examination is implemented according to the requirements of selecting and cultivating different art professionals. The city’s unified examination is organized by Beijing Education Examinations Institute, and the college examinations are organized by relevant universities.

The "Notice" mentioned that by 2024, the city-wide unified professional examinations for six art majors, including music, dance, table (guide) performance, broadcasting and hosting, art and design, and calligraphy, will be fully implemented.

Music includes seven majors, such as music performance, musicology, composition and composition technology theory; dance includes six majors, such as dance performance, dance science and dance choreography; table (directing) performance includes five majors, such as performance (drama film and television performance), drama film and television director and musical; and art and design includes 28 majors, such as fine arts, painting, sculpture and photography, in addition to broadcasting and hosting and calligraphy.

screenshot

The "Notice" also mentioned that the scope and scale of school examinations should be strictly controlled. For the art enrollment majors covered by the Beijing unified examination, in principle, colleges and universities in Beijing should directly adopt the results of the unified examination. For a few art colleges with distinctive professional characteristics and high quality of personnel training, and high-level art majors with high requirements for candidates’ artistic talent, professional skills or basic skills, they can apply for organizing school examinations on the basis of the city’s unified examinations according to procedures.

Colleges and universities in Beijing that organize school examinations should actively take online examinations or use the results of provincial unified examinations for primary elections, and strictly control the number of on-site school examinations. In principle, it should not exceed 6-mdash of the enrollment plan of relevant majors; Eight times.

From next year, there will be new changes in the college entrance examination art test!

In 2021, the Ministry of Education issued "Guiding Opinions on Further Strengthening and Improving the Enrollment of Art Majors in Colleges and Universities" (hereinafter referred to as "Guiding Opinions"), and comprehensively launched the enrollment reform of art examinations.

It can be noted that since the beginning of this year, Shanxi, Xinjiang, Guangdong, Zhejiang, Hunan and other provinces have issued relevant implementation plans to promote the enrollment reform of the college entrance examination.

According to relevant local documents, from 2024 onwards, there will be several new changes in the enrollment of college entrance examination art examination. First, the college entrance examination art test will enter the "unified examination era". It is mentioned in the Guiding Opinions that all provinces (autonomous regions and municipalities) should actively create conditions to gradually expand the scope of the provincial-level unified examination for art majors, and basically achieve full coverage of the provincial-level unified examination for art majors by 2024.

At present, the provincial-level unified examinations for art majors in various places set up six categories, including music, dance, performance, broadcasting and hosting, art and design, and calligraphy. All localities have issued documents to make specific provisions on the subjects, scores, contents, forms, requirements and various aspects of examination organization and implementation.

In addition, many places also informed that starting from 2024, there will be no more inter-provincial examination sites, and all college art majors will be organized at the school location.

Second, some art majors will cancel the professional ability examination. According to the above Notice of Beijing Education Examinations Institute, since 2024, art majors such as art history theory, drama, film and television literature in colleges and universities will be selected according to the results of the cultural courses in the college entrance examination and the comprehensive quality evaluation of candidates.

Among them, art majors that no longer organize professional ability examinations include art history, art management, intangible cultural heritage protection, drama, film studies, drama film and television literature, radio and television director, and film and television technology.

Third, the performance requirements of cultural courses will be gradually improved. Zhejiang Education Examinations Institute requires that from 2024 onwards, the art majors in colleges and universities that organize school examinations will be selected according to the candidates’ school examination results on the basis that the results of the college entrance examination and cultural courses in Zhejiang Province are qualified in principle and meet the minimum requirements set by the school. According to the enrollment situation, the school can apply for an appropriate reduction in the performance requirements of cultural courses, but it shall not be less than 75% of the general class.

Hunan Education Examinations Institute mentioned that colleges and universities are encouraged to further improve the requirements for admission of cultural achievements on the control scores uniformly delineated by Hunan Province. On this basis, in the future, we will gradually improve the cultural performance requirements of the college entrance examination for arts majors. From 2025, the admission control scores of relevant subjects will be increased from 75% and 70% of the minimum control scores of ordinary undergraduate courses to 80% and 75% respectively.

The Guangdong Education Examinations Institute also mentioned that in 2024, the proportion of the total scores of candidates’ cultural courses with the combined total scores of music, dance, performance, art and design, and calligraphy was appropriately increased. (End)